Wednesday, November 28, 2007

How we seek news information

The Big J

"I believe Big Journalism cannot respond as it would in previous years: with bland vows to cover the Adminstration fairly and a firm intention to make no changes whatsoever in its basic approach to politics and news. The situation is too unstable, the world is changing too rapidly, and political journalism has been pretending for too long that an old operating system will last forever. It won’t. It can’t. Particularly in the face of an innovative Bush team and its bold thesis about the fading powers of the press."

Too often in mainstream media today, the desire for “objectivity” undermines the need for historical and contextual framing of the issues, severely reducing the quality of the news. The rise of capitalism and a consumer-driven market, public disengagement from the issues, distrust for the press, political attacks on the press’s credibility and failures within the institution of journalism are responsible in varying degrees for the current dismal state of the media. However, the history of journalism is riddled with public dissatisfaction and the deleterious effects of commercialization. Nonetheless, what seems to affect news content more than any other factor is the prevailing ideology of the times.

In Herbert Altschull’s From Milton to McLuhan, periods of optimism followed the rise of

What defines American journalism today is the convention of today. Prior to 9/11 we had a press and a public preoccupied with entertainment and trivialities, caught up in consumerism and celebrities. Now, though frustration and distrust emanate from public opinion polls and news analyses, following government scandals, political manipulation and failures, Americans are no more educated or socially engaged than they were at the beginning of 2001. Society increasingly moves toward a liberal individualism where, citizens become merely individuals and communities become obsolete. Liberal individualism defines the capitalistic notion of emphasizing individual worth and need over those of the collective. As such, education becomes a training ground for future professionals and anthropology, history and philosophy become electives.

In the information age of today, bubbles of information replace history and context, dooming the public and the press to repeat mistakes of the past. As Harvard philosopher, George Santayana famously said, “Those who cannot remember the past are condemned to repeat it.” The press also has forgotten its history, its era of social responsibility, of muckraking of optimism and pessimism. As if the press had come down with a case of Alzheimers, it remembers only the basics of daily operation, like walking, talking and eating. The ideology is pragmatism, not as John Dewey or Walter Lippmann would have it, but pragmatism poorly defined as the concrete systematic process whereby truth is unearthed. The motto, Altschull writes, is: “Ideas do not exist independently in the mind; they only arrive in terms of our experiences, in facts and not thought.”

Journalism comes to resemble a trade, like welding, rather than a public service for the public good. Through the glorification of objectivity, many would argue that journalism does not predicate an ideology, but rather the lack of one. However, the denial of an ideology is an ideology. Objectivity is rationalization without the human will. Rationalization has become

They thought the Earth was flat

Racism was obvious in the Emmett Till trial, and yet the murderers were acquitted. The brutality of the racism however, brought down a shower of media attention from Northern reporters and rebellious Southern editors. In the

Looking back at the Civil Rights Era, we often think we see a distant past, instead of a very recent one. The belief that products of the Civil Rights Act, such as affirmative action, have settled the score ignores the reality of the act as more of a principle than a common practice for at least 20 years after. Though some progress is evident, the effects of policy change in 1964 were far from immediate and the lag suggests that sentiments of the past do not fade at the signing of piece of legislation.

The Equal Employment Opportunity Commission’s Web site says that when they began accepting employment discrimination claims in 1964, they were faced with an immediate backlog of 1,000 claims. The EEOC also admits that it was consistently faced with staff and funding shortages and for many years unable to even review over half of the claims that poured into the office. Studies show that in the 1980s, affirmative action weakened “as a result of lax enforcement of affirmative action regulations in the early years of the Reagan administration." (Holzer, Harry & Neumark, David. "Assessing Affirmative Action." Journal of Economic Literature, 38. 3:2000 pp. 483-568)

The AFL-CIO's American Federationalist in 1986 wrote, "Despite the fact that the Civil Rights Act is more than 20 years old, many barriers to equal access to jobs, promotions and other employment opportunities still remain…The Reagan Administration's record on affirmative action is deplorable…The Administration seeks to use the civil rights laws to thwart the full political and economic participation of women and racial minorities in our society rather than as a means of furthering that goal.”

Similar examples exist even today, in city planning ordinances that seem to reinforce segregation in public schools, and in the disproportionate distribution of subprime loans to minority families, expected to spawn millions of foreclosures and kick people out of their homes.

The vicious beating of Northern black boy by Southern whites gained national attention and lead to gradual change because the media persistently and adamantly reported it to the public. Racism then, and now, is defined as the infliction of harm on an individual or group because their race is deemed inferior. Today the beating is soft and slow, but the disproportionate infliction of harm on groups of people, “once deemed inferior,” is also significant. Journalists would do good to remember that the murder of Emmett Till took place during a time when John Lennon thought the Beatles were bigger than Jesus, not when people thought that it was possible to steer a ship off the edge of the Earth.

Tuesday, November 20, 2007

News on the Pew study can't point to this data?

"High-cost subprime mortgages have often been framed as loans that catered to people with blemished credit records or little experience with debt.

There has been less attention paid to the concentration of these loans in neighborhoods that are largely black, Hispanic, or both. This pattern, documented in federal loan records, holds true even when comparing white middle-income or upper-income neighborhoods with similar minority ones.

Consider two neighborhoods in the Detroit area. One, located in the working-class suburb of Plymouth, is 97 percent white with a median income of $51,000 in 2000. To the east, a census tract in Detroit just inside Eight Mile Road has a very similar median income, $49,000, but the population there is 97 percent black.

Last year, about 70 percent of the loans made in the Detroit neighborhood carried a high interest rate — defined as 3 percentage points more than the yield on a comparable Treasury note — while in Plymouth just 17 percent did.

Last year, blacks were 2.3 times more likely, and Hispanics twice as likely, to get high-cost loans as whites after adjusting for loan amounts and the income of the borrowers, according to an analysis of loans reported under the federal Home Mortgage Disclosure Act. (Asians are somewhat less likely than whites to take out high-cost loans.)

Researchers and industry officials agree that there is probably no single explanation for the lending patterns, though the history of banks’ avoiding minority neighborhoods, the practice known as “redlining,” is a good place to start. (Experts have to resort to guesswork because the government does not require lenders to report information about borrowers’ credit scores, down payments and other details used in pricing loans.)

Lenders say that in general higher rates are justified to account for the bigger risks posed by borrowers who have a poor record at paying bills on time and defaulting on debts. And a recent Federal Reserve study noted that neighborhoods where people tend to have lower credit scores also tend to a greater concentration of high-cost loans.

The study suggests that the concentration of high-cost loans is not caused by an area’s racial makeup, though there is a correlation, said Jay Brinkmann, vice president for research and economics at the Mortgage Bankers Association.

But the Fed study also suggests that a big part of the reason may have to do with the lenders that minority borrowers do business with. The biggest home lenders in minority neighborhoods are mortgage companies that provide only subprime loans, not full-service banks that do a range of lending.

It may be that these borrowers do not have access to traditional banks, because there are no branches near them. The Community Reinvestment Act, enacted 30 years ago, was intended to address redlining by forcing banks to make loans in lower-income areas. But the law’s provisions do not apply to banks in neighborhoods where they have no branches.

“You could go into a middle-class area in Queens County that is white and there will be lots of banks on the shopping street,” said Alfred A. DelliBovi, president of the Federal Home Loan Bank of New York and a deputy secretary of the Department of Housing and Urban Development in the first Bush administration. “If you go to an area that is equal income and that is black, you won’t see many.”

Banks typically locate branches where they believe they will get the most deposits. A lower savings rate and a distrust of banks stemming from a legacy of redlining may help explain why there are fewer branches in minority neighborhoods, Mr. DelliBovi said.

A bigger reason may be that in recent years many subprime loans were not sought out by borrowers but actively sold to them by brokers and telemarketers, said Calvin Bradford, a housing researcher and consultant. A majority of the loans were refinance transactions allowing homeowners to take cash out of their appreciating property or pay off credit card and other debt.

Lenders made the risky loans, then often sold them to Wall Street investors. Many borrowers appear to have been swayed by brokers and lenders offering to look out for their best interests even when they had no obligation to do so.

“If we turn the clock back 30 years ago, we had redlining,” said Nicholas Retsinas, director of the Joint Center for Housing Studies at Harvard University. “In the last few years, we have had the opposite — an overextension of credit by lenders and an overextension by borrowers.”

The country needs to find a balance, “a way to extend credit at a reasonable cost to people with impaired credit,” he said. The government, through programs like the Federal Housing Administration and the big mortgage purchasers Fannie Mae and Freddie Mac, must play a critical role, Mr. Retsinas said, adding that he worries that the efforts initiated so far are not robust enough.

“There are lots of people trying to do the right thing,” he said. “But at this time I’m not very sanguine that we will deal with this in a concerted manner.”"

The Arguments and The Numbers

Media sing 'po-po black floks' tune

"Since shortly after the signing of the Civil Rights Acts of 1964-65, and the advent of the Great Society Initiatives, blacks have been systematically stripped of their dignity and converted from self-sufficient, pride-filled, patriotic Americans to wards of a liberal nanny government who are motivated by rage, resentment and animus.

The flames of anger are fanned, vis-à-vis a proscribed polarization based on the color of one's skin, by those who risk the greater loss, if and when blacks come to their senses

Following are examples of a Pew Research Center study and how same is being used to keep dependent on liberals for their dinner at Barmecide's table. The lead paragraph of an article in the liberal Washington Post read, "Nearly half of [blacks] born to middle-income parents in the late 1960s plunged into poverty or near poverty as adults, according to a new study – a perplexing finding that analysts say highlights the fragile nature of middle-class life for many [blacks]."

It continued, "[In] a society where the privileges of class and income perpetuate themselves from generation to generation, black Americans have had more difficulty than whites in transmitting those benefits to their children" ("Middle-class dream eludes African-American families," Nov. 13, 2007).

Space constraints prevent me from an expansive parsing of this flagrant falsity, but suffice it to say the paralyzing effects of the "Great Society" began in the late 1960s. It ushered in the period of the non-consequential abandonment of sobriety (read: morality), as the government stood at the ready with checkbook in hand to reward same. Clean, pridefully maintained public housing neighborhoods became cesspools; mothers were compensated (read: rewarded) by the child, but only if the father was excluded. This period gave rise to pandemics of drugs, crime, social alienation and failing schools. I see nowhere in the article where these factors were considered.

Massies argument should not be taken with great warrant, because it fails to cite how "great society" initiatives led to "pandemics of drugs crime social alienation and failing schools. Rather, here are some statistics that might help us understand the context of the Pew Research Study.

The belief that affirmative action practices have already settled the score and that white youth are made to feel guilty for the injustices of their ancestors, ignores the reality of affirmative action as little more than a principle, with little evidence of enforcement. “According to one highly-place source, the AFL-CIO leadership supported this bill because they believed that a commitment to integration in principle might ward off measures that could bring it about in practice.” (Orfield and Shkinaze, The Closing Door: Conservative Policy and Black Opportunity, pg 58,59) So the principal was enacted, and when the Equal Employment Opportunity Commission began accepting charges, they were faced with an immediate backlog of 1,000 charges, or complaints, according to their Web site. In the 1980s the EEOC underwent a philosophy revision, without increase in staff or revenues, from a focus on systemic discrimination to thorough individual cases. Studies show "that affirmative action on

employment weakened in the early 1980s, as a result of lax enforcement of

affirmative action regulations in the early years of the Reagan administration." (Holzer, Harry & Neumark, David. "Assessing Affirmative Action." Journal of Economic Literature, 38. 3:2000 pp.483-568)

The AFL-CIO's American Federationalist wrote on affirmative action in August, 1986:

"Despite the fact that the Civil Rights Act is more than 20 years old, many barriers to equal access to jobs, promotions and other employment opportunities still remain. effective affirmative action plans are as necessary now as those plans were in 1964 to ensure that minorities and women take their rightful places in our economic system and to achieve equality and harmony among the races.

The Reagan Administration's record on affirmative action is deplorable. The Administration is leading the reactionary effort in the courts to end affirmative action and is taking steps to weaken Executive Order 11246. This order forbids government contractors from discriminating in employment and requires them to engage in affirmative action. The Administration seeks to use the civil rights laws to thwart the full political and economic participation of women and racial minorities in our society rather than as a means of furthering that goal.

The AFL-CIO has often stated its unwavering support for affirmative action and condemns the Administration's efforts to end such programs. While Title VII protects bona fide, nondiscriminatory seniority systems that provide important ptotection to all workers regardless of race or sex, the Civil Rights Act also permits workers in free collective bargaining to negotiate affirmative action plans, including plans that modify such seniority systems.

The 1984 Supreme Court decision in the Stotts case endorsed the position long held by the AFL-CIO that bona fide nondiscriminatory seniority systems are legal under Title VII of the 1964 Civil Rights Act as amended. These systems provide valuable and needed protection for all workers regardless of race or sex."

To highlight the effect of the nondiscriminatory seniority system under Title VII of the 1964 Civil Rights Act, which undermined affirmative action, studies found that policies that supportes seniority-based layoffs hurt black workers more than white workers in the 1973-74 recession. "While white males averaged 63 percent of initial employment, they accounted for 78 percent of the employment decline. Since females and minorities typically have lower seniority, they are usually found to suffer disproportionately more during a downturn." (Leondar, Jonathan. "The Impact of Affirmative Action Regulation and Equal Employment Law on Black Employmen." The Journal of Economic Perspectives, 4. 4:1990, pp. 47-63)

Another study cited above assessed over 20 years of research on affirmative action and concluded the effects are ambiguous. (Holzer, Harry & Neumark, David. "Assessing Affirmative Action." Journal of Economic Literature, 38. 3:2000 pp. 483-568)

It concludes:

"Significant labor market discrimination against minorities and women persists, as do other forms of disadvantage for minorities in the attainment of human capital (which some refer to as "societal discrimination"). Affirmative action programs redistribute employment, university admissions, and government business from white males to minorities and women, though the extent of the redistribution may not be large."Futhermore,

"All in all, the evidence suggests to us that it may be possible to generate affirmativeSo, then we see that affirmative action does have some positive impact on the distribribution of employee opportunity and has ambiguous effects on company efficiency and "reverse discrimination." So if to some extent affirmative action does help diversify our workforce, and it's negative effects are a wash, then I find it hard to believe that these programs are the cause of problems facing black communities, and even harder to believe that these programs disadvantage other non-minority members of society, so rather we should take our focus away from affirmative action and look at how our schools are funded, who gets a better education, how our schools are divided, how mortgage loans are distributed, the dynamics of property tax increases and urban development.

action programs that entail relatively little sacrifice of efficiency. Most importantly, there is at this juncture very little compelling evidence of deleterious efficiency effects of affirmative action. This does not imply that such costs do not exist, nor that the studies we review have captured the overall welfare effects of affirmative action. It does imply, though, that the empirical

case against affirmative action on the grounds of efficiency is weak at best.

...Affirmative action offers significant redistribution toward women and minorities, with relatively small efficiency consequences. A major outstanding question that could tip the scales more in the direction of efficiency gains is the extent to which this redistribution increases

efficiency by countering discrimination in the labor market. We have argued that there is evidence of continuing discrimination against women and minorities. In this case it is possible that affirmative action generates additional efficiency gains, although theory does not necessarily imply this."

Differing Views on Differing Views

Forty Acres and a Gap in Wealth

New York Times Opinion article by Henry Louis Gates Jr., a professor at Harvard and the author of the forthcoming “In Search of Our Roots.”

Others tend to make greater assumptions about attitudes and the influence of recent news stories, such as Jena 6 and Katrina, even though the poll was conducted over a span of nearly 40 years and attitude trends."Perhaps Margaret Thatcher, of all people, suggested a program that might help. In the 1980s, she turned 1.5 million residents of public housing projects in Britain into homeowners. It was certainly the most liberal thing Mrs. Thatcher did, and perhaps progressives should borrow a leaf from her playbook.

The telltale fact is that the biggest gap in black prosperity isn’t in income, but in wealth. According to a study by the economist Edward N. Wolff, the median net worth of non-Hispanic black households in 2004 was only $11,800 — less than 10 percent that of non-Hispanic white households, $118,300. Perhaps a bold and innovative approach to the problem of black poverty — one floated during the Civil War but never fully put into practice — would be to look at ways to turn tenants into homeowners. Sadly, in the wake of the subprime mortgage debacle, an enormous number of houses are being repossessed. But for the black poor, real progress may come only once they have an ownership stake in American society.

People who own property feel a sense of ownership in their future and their society. They study, save, work, strive and vote. And people trapped in a culture of tenancy do not."

Many more bridges to cross: Opinions of black Americans

Alabama's Anniston Star opinion desk writes:

"The obvious answer — or at least the first that comes to mind — is economics. Although income in black families has risen, the increase is largely due to black women moving significantly into the workforce. Meanwhile, a decline in the income of black men has been offset by income gains by black women, a trend which, if it continues, might cause policy makers to dust off earlier research on the condition of the black male in America.

But economics is only part of the answer. Two recent events — the case of the Jena Six and the federal and state response to Hurricane Katrina — seem to weigh heavily on the minds of those polled. The arrest of six young black students for beating a white classmate, even though white students were involved in related racial incidents, made some respondents uncertain about America’s racial progress. And the nation’s response to the Katrina disaster was seen as a lack of commitment by the government to a black community in distress.

Equally unsettling is that more often than not, whites who were polled saw a much brighter picture, suggesting not only a differing opinion but a differing perspective, as well.

Despite these disturbing revelations, the Pew poll also showed that an increasing number of blacks feel that they and their white counterparts share similar values, and that even though blacks believe prejudice is pervasive they do not blame prejudice for their situation. Self-reliance and responsibility, values whites and blacks share, are seen as critical elements to making things better."

Wednesday, November 14, 2007

Racism, a thing of the past? Really!?

Blacks See Growing Values Gap Between Poor and Middle Class

"Big gaps in perception between blacks and whites emerge on many topics. For example, blacks believe that anti-black discrimination is still pervasive in everyday life; whites disagree. And blacks have far less confidence than whites in the basic fairness of the criminal justice system."

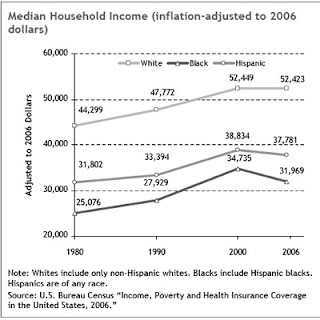

"According to 2006 Census data, the gap between black and white median household incomes has remained roughly similar for many years. The gap closed somewhat in the late 1990s, only to widen again this decade. The gap between Hispanic and white incomes has widened in recent years as Latino immigration has increased."

Friday, November 9, 2007

The bracing civic goodwill in the air nicely complements the crisp autumn weather...

Developing Story: Community Convergences

The problematic context, of course, is gentrification and diminishing housing affordability in East Austin. While investment in a disinvested community is in theory a good thing, on the Eastside it's happening so fast that longtime residents are being displaced. As one speaker put it: "The tidal wave of market forces is rising too quickly, with little or no time to adjust. The dam has broken, and the water is coming over." In the 78702 ZIP code, for example (bounded by I-35 and Airport Boulevard, between the river and Martin Luther King Boulevard), the median sale price of a home in 2000 was $77,000. It since has shot up more than 250% to $195,000 (with a 150% increase just since 2005), with property taxes to match.Gregor's bracing civil goodwill has done little to solve East Austin's problems, and though civility is all fine and dandy, especially when it complements the crisp autumn air and slow-falling leaves, manners don't cost a thing, but life in East Austin is growing farther and farther from that.

Pitty also, that there's not more coverage from the city of Austin's "alternative" publication, because as we well learn, issues require exhausting press coverage for policy change to occur.

Wednesday, November 7, 2007

Dubious Lenders Robbing Imperiled Borrowers

Esoteric systems of discrimination come in various forms, one of them is mortgage loans.

About 46 percent of Hispanics and 55 percent of blacks who took out purchase mortgages in 2005 got higher-cost loans, compared with about 17 percent of whites and Asians, according to Federal Reserve data.

According to the New York Times, Nov.7, lenders' practices have been, "taking advantage of imperiled borrowers."

Dubious Fees Hit Borrowers in Foreclosures

Lenders and loan servicers often do not comply with even the most basic legal requirements, like correctly computing the amount a borrower owes on a foreclosed loan or providing proof of holding the mortgage note in question.

Testifying before Congress on Tuesday, Mark Zandi, the chief economist at Moody’sEconomy.com, estimated that two million families would lose their homes by the end of the current mortgage crisis.

Now that big lenders are originating fewer mortgages, servicing revenues make up a greater percentage of earnings. Because servicers typically keep late fees and certain other charges assessed on delinquent or defaulted loans, “a borrower’s default can present a servicer with an opportunity for additional profit,” Ms. Porter said.

The amounts can be significant. Late fees accounted for 11.5 percent of servicing revenues in 2006 at Ocwen Financial, a big servicing company. At Countrywide, $285 million came from late fees last year, up 20 percent from 2005. Late fees accounted for 7.5 percent of Countrywide’s servicing revenue last year.

But these are not the only charges borrowers face. Others include $145 in something called “demand fees,” $137 in overnight delivery fees, fax fees of $50 and payoff statement charges of $60. Property inspection fees can be levied every month or so, and fees can be imposed every two months to cover assessments of a home’s worth.

Since the Civil Rights Act of 1964, the real estate and loan industry continuously displayed discriminatory practices against black and Hispanic families. The banking industry disproportionately denied black families mortgage loans, inhibiting opportunities for asset accumulation, which through history has proved a very beneficial factor in financial security for white families in America down generational lines. As we can see, things haven't changed much.